The other day I read this article over on ZeroHedge from a small business owner in the US on why businesses like his were the dwindling exception. He cited 9 reasons the deck is stacked against the owner-operated small business, they were mainly specific to bricks-and-mortar shops in the U.S., but it resonated with me because the same systemic flaws affect internet businesses as well.

The other day I read this article over on ZeroHedge from a small business owner in the US on why businesses like his were the dwindling exception. He cited 9 reasons the deck is stacked against the owner-operated small business, they were mainly specific to bricks-and-mortar shops in the U.S., but it resonated with me because the same systemic flaws affect internet businesses as well.

Here are 3 reasons small, independent internet businesses are dwindling. I’ll define small, indie businesses as the segment in between kitchen table businesses (mom and pop, working from home) and say, 50 employees or more. So companies that earn their living on the internet, have an office, employees, etc.

Why are these businesses progressively more squeezed?

1) Venture Capital & Private Equity.

I probably can’t do it justice here, but let’s try. The monetary system itself is inherently flawed. Because we use debt for money, the money supply must constantly expand and it must do so at a higher rate than interest servicing the underlying debt, or else you enter what’s called a “credit contraction” and it feels like heroin withdrawal to a debt-fueled economy.

So, when you hit the late stages of a credit induced boom – such as we are today (one might even call it, beginning of the endgame of the super-bubble that started in [pick one] 1982, 1971, 1913) – you can only keep the game going by artificially suppressing interest rates and expanding the money supply (a.k.a “Quantitative Easing”, “Abenomics”, etc)

When you hold down interest rates, you screw savers and you wreck capital formation. Gone are the days when you could make a million dollars, put it in the bank, live off the interest and retire (unless your retirement includes eating dog food and living in a hostel).

The effect of all this is that everybody needs to reach for yield now. All money becomes “Hot Money”. Passive income is over, you need capital gains, you need a grand slam and then you need to roll it over and do it again, and again and again.

That’s where VC and Private Equity comes in.

You have a small indie web business doing business “the old fashioned way” (at a profit). They’re charging a fair price for decent value and making a respectable living at it. By it’s nature, this attracts competition. Normally that’s fine because all else being equal that keeps everybody honest.

But now we’re in a climate where money is eroding and profits are passé. There is Big Money out there and they have no yield: pension funds, endowments, sovereign funds – they can’t protect their capital base and grow to meet their future obligations in this environment. They need yield and the only way to get it these days is to hit a few Grand Slams (hence you’ll see things like the Canada Pension Plan buying a piece of Skype)

So they place capital with Venture Capital or PE funds, and they go out and proceed to financialize any segment they can corner: roll ups, escalating up-round financings, monster acquisitions and IPOs. Half the companies they’ll bankroll have no profits, let alone business model, and the other half that has an actual business model will have their profits sacrificed in order to gain market share.

In an economy completely fueled by escalating debt and Hot Money, market share is more important than profits because the “investors” are out to make their returns on financial events, not on the actual operations of a given business. (There are rare exceptions. Tucows comes to mind, and ironically, Tucows is a well kept secret).

This leaves the businesses who refuse to participate in this in a bit of a quandary. These companies don’t have “burn rates”, they have profits and losses. They’re driving home from the office and they see billboards from their competitors (CoolKidsCo.io) along the highways. Their competition takes out Superbowl ads, has F1 sponsorships and the competition is losing hundreds of millions of dollars per year. But all they hear from their customers is “Yes, but you charge $20/year and I can get it from CoolKidsCo.io for $10!”

(Or even free, as Bruce Sterling lamented in his must-read essay The Internet of Things):

“disruption involves a public proof that the rival shouldnt even exist. The rivals services are meaningless; they should, properly, be mere commodities, or even given away for free

Because in this New Economy world, profits are something you monetize on the back end, sometime in the future (probably by somebody else) once the VC’s or Private Equity firms have hit their Grand Slam and exited, looking for the next big/hot/cool thing.

2. Bureaucracy & Regulations:

The internet has this reputation as being this Wild West unregulated anarchy where people can do whatever the hell they want in the privacy of their own homes and minds (pretty scary). But it is quickly becoming less so, and almost a truism that those seeking to regulate it are the least knowledgeable about it.

As regulation becomes a bigger chunk of the internet landscape, internet businesses have to devote more of their cycles to compliance and reporting, something that again, works to the advantage of larger, well connected, Hot Money fueled players and to the detriment of the smaller ones.

The best way I’ve heard this described was in a meeting with a very high powered law firm here in Toronto last year when we met for a half day to discuss bitcoin, the bitcoin economy and how best a firm might approach entering the field.

The Entrepreneur-In-Residence there described it (paraphrasing):

Step 1: You need funding, you have to be BIG (Hot Money to the rescue again, because a bank would never touch it)

Step 2: You use that funding to build in-house regulatory and legal expertise and you set about lobbying the policymakers and regulators.

Step 3: You help craft legislation around your newborn industry, and because you’re there you get to shape it in a manner beneficial to you.

Step 4: Regulation proceeds within the space in an ever escalating manner, and you, as the first mover and shaper of said regulation, get to (and I remember this quote exactly) “climb up ahead of it and pull the ladder up behind you

And that’s how a new business segment gets created when it needs regulatory blessing to exist.

Further, because we’re talking about the internet, there is an absolute mess of cross-jurisdictional issues which can easily crush the smaller, independent player like a walnut.

Anybody following this space knows about the various ongoing sagas we face with the London UK PIPCU and the US FDA. The latter was instructive because when they came to us seeking to takedown a website without a court order I asked them, “why can’t you just go to Verisign and have them do it?” to which they replied – “Because Verisign will want a court order. Uhm ok. So how come it’s ok for Verisign to demand a court order but it’s not ok for easyDNS to want one? The answer is: Because Verisign is a multi-billion dollar entity with a powerful monopoly, legal muscle and lobbyists to spare.

Now we’re told that the European Union will want, starting next year, all non-Euro businesses to begin collecting and remitting VAT on their European purchasers. In other words, we all get to become unpaid tax collectors for a foreign government.

We’re sure some of the larger entities will simply tell them to Go To Hell, as Microsoft has told the Justice Department to do so in the matter of surrendering personal data of it’s customers held offshore. Microsoft can do that, your average indie business? It’s a hell of a risk.

3 The Criminal Underworld:

Around 10 years ago I was misquoted in an article about email spam. I said “Sometimes it feels like we’re rejecting more spam than we are relaying legit email”. The article (in typical journalistic competence) said “Mr Jeftovic says his firm is relaying more spam than legitimate email”.

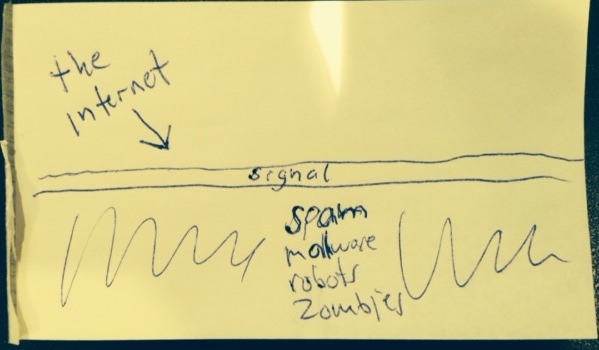

I was mortified at the misquote. Today that’s the reality. I once scribbled this (in Hugh McCleod “Gaping Void” style) on a piece of paper:

A quick look at today’s mail forwarding logs: we’re rejecting roughly 8 messages for every 1 we’re relaying.

DDoS attacks are particularly pernicious because of the asymmetric cost/benefit curve compared to Big Money incumbents.

If you run a business supplying internet infrastructure of any kind, or selling a product or service, you will get DDoSed, sooner or later.

The problem is that botnets don’t scale based on size of target. They just clobber whatever they’re trained on. This means that small indie infrastructure companies are going to get hit with the same size and scale of DDOS attacks that hit Microsoft or Google. Which means the small indie company has to mitigate the same size attacks or effectively go out of business.

DDoS mitigation is expensive. I personally spend more on DDoS mitigation for easyDNS than I draw for my own salary. Which kind of sucks because every time I write one of those checks I ruminate that in a world without DDoS attacks I could be making payments on a summer home instead of to a DDoS mitigation company (Sorry Staminus, you know we love you guys but it’s true). It’s a necessity.

Of course, Paul Vixie would tell you (watch this video), that if the internet adopted BCP38, DDoS attacks would be a shadow of their former selves. But, there is no incentive for carriers to adopt it, unless one emerges from the marketplace. (and as we observed above, in this environment “saving piles of money on DDOS mitigation” isn’t an incentive. “Will it help us get acquired by Facebook?” probably not.)

Once again, small indie == disadvantage. Google could probably force transit suppliers to adopt BCP 38. easyDNS couldn’t. But because of the asymmetric cost curve of mitigating DDOS attacks, Google doesn’t really need BCP38. They can mitigate the same DDOS attack with their eyes closed while the small indie operater has to take out a second mortgage on his house.

Those are the three big factors that make it tough for small business on the internet. We haven’t even gotten to the part where you still have to, you know, “run the business”, which is what you do in the Copious Spare Time you have left over from dealing with the factors outlined above.

My hat is off to any independently owned operators / businesses out there who carve out viable niches, successfully adapt with the changing times, and resist the temptation to throw in with the Hot Money wave of consolidation and financialization. I think long term that is a losing proposition.

There is an old Wall Street adage: “The market can remain irrational longer than you can remain solvent”. Indies have to disprove this. The mantra has to be “We can remain viable longer than the market can remain a monstrosity cooked up in an economic meth lab”

It could be because I’ve been on my ass for over a week and slowly getting cabin fever. This post wasn’t meant as a “woe is me” rant, as I mentioned in “Growth for Growth’s Sake Leads To Nowhere”, I’m a curmudgeon, not a suck. I wouldn’t want some kind of government regulation to “fix” the problems outlined (primarily because government interventionism is a big part of the problem itself). I wouldn’t trust them to get it right (although, with a stroke of a pen, if the government made BCP 38 a requirement, they just might accomplish a whole lot more than anything else they’ve tried in this sphere).

But what both the original ZeroHedge article and this one are saying is this: the policy mismanagement of attempting to macro-economically engineer a global recovery via credit expansion and interest rate manipulation are not abstract, theoretical constructs to be argued by the Paul Krugmans of the world – it all has real world ramifications. Tell somebody “interest rates are too low” and their eyes glaze over. Tell them “artificially suppressed interest rates are wrecking your industry” or maybe “will cost you your livelihood” and maybe you will get their attention.

I remain, a free market believer. Not “free market” in the sense of “deregulation as socialism for big banks, privatized profits and socialized losses”, I mean free markets that will eventually revert to the economic laws that say you cannot print your way to prosperity, you cannot achieve wealth by pyramiding debt and that eventually, sane economic models will prevail.

I also believe we are in a key transition point at a societal and economic level. The fallacies of current conventional wisdom are beginning to breakdown in non-repudiable ways. It is getting harder and harder to gloss over the systemic flaws in the system and pretend that we are in anything resembling a global economic recovery (because we’re not, we’re in some sort of sleeper version of what Austrian economists called A Crackup Boom)

Having a long term horizon isn’t a cliche, it’s a survival strategy (not to mention a sanity strategy).

Couldn't you partner with CloudFlare so more of your clients would use them?

Could that potentially reduce your own anti-DOS bill?

1- Some people/companies may want to use both your service and CloudFlare. I do..

2- Not only it may help reduce your bill, but will make it easier for people to get their records from your service to CloudFlare. Right now there is not easy way to get all records (last I checked you don't have a zone export option) to CloudFlre.

3- The CloudFlare interface is just outright horrible when you have a large set of domains. It would be fantastic if you had a way to sync between your service and them and do some of the basics such as enable/disable a given IP for protection

We have actually been using Cloudflare for a few months in addition to Staminus. Cloudflare is the mitigation behind dns2.easydns.net, we also plan to build integrations into them the same way we have have integrations for Route 53, Linode and more to follow. (Unfortunately it makes for an even bigger anti-DDoS expense, but as a DNS company we have this "thing" for redundancy, hence dual DDOS mitigation partners …)